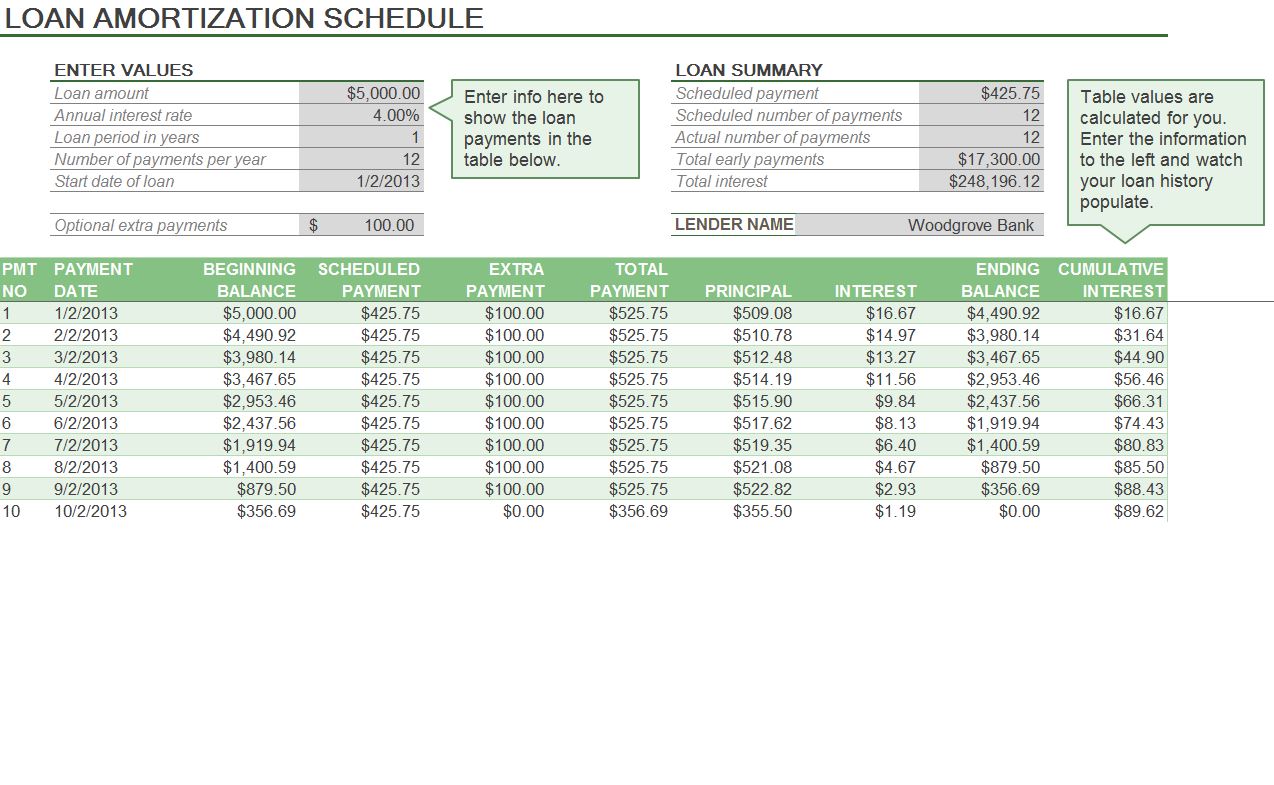

This means that each monthly payment the borrower makes is split between interest and the loan principal. With an amortized loan, principal payments are spread out over the life of the loan. Common types of amortizing loans include: This helps the borrower save on total interest over the life of the loan.Īmortizing loans include installment loans where the borrower pays a set amount each month and the payment goes to both interest and the outstanding loan principal. Any amount paid beyond the minimum monthly debt service typically goes toward paying down the loan principal. Loan amortization determines the minimum monthly payment, but an amortized loan does not preclude the borrower from making additional payments. More of each payment goes toward principal and less toward interest until the loan is paid off. Under this type of repayment structure, the borrower makes the same payment throughout the loan term, with the first portion of the payment going toward interest and the remaining amount paid against the outstanding loan principal. What Is an Amortized Loan?Īn amortized loan is a form of financing that is paid off over a set period of time.

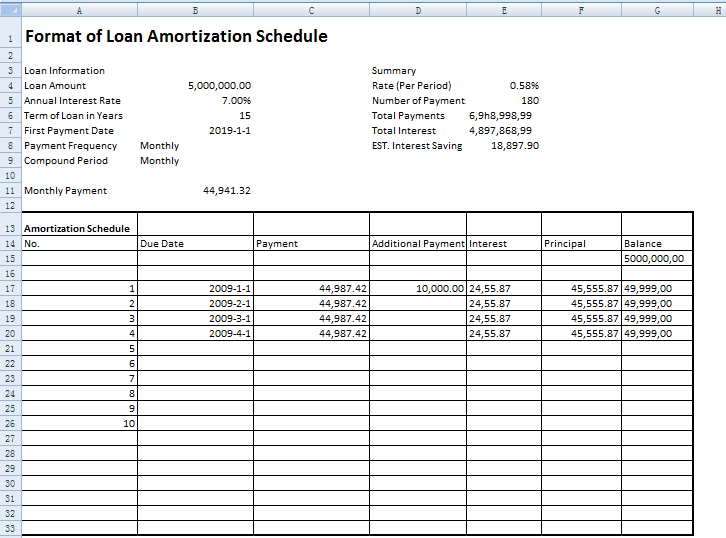

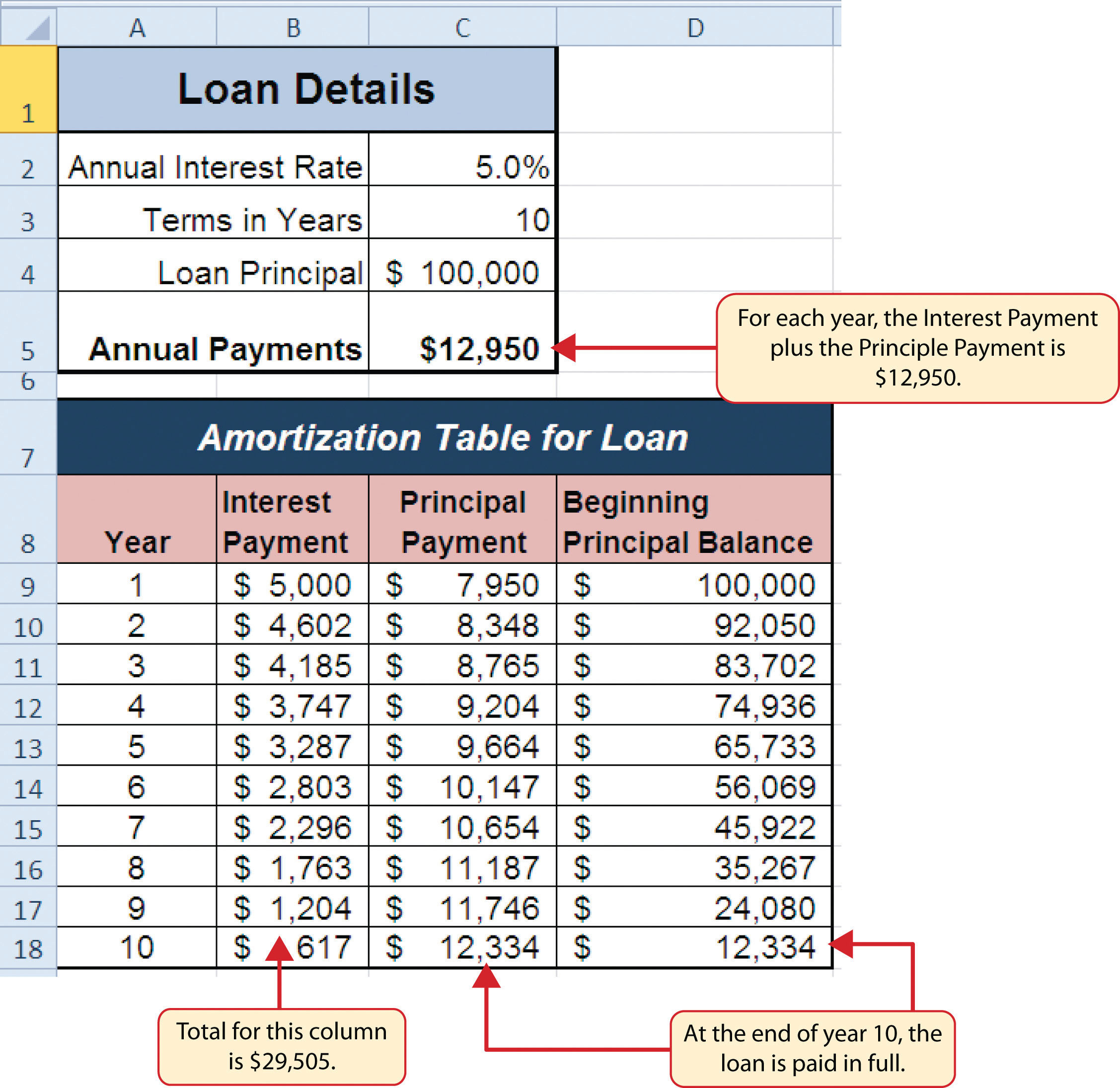

However, amortization tables also enable borrowers to determine how much debt they can afford, evaluate how much they can save by making additional payments and calculate total annual interest for tax purposes.

Lenders use amortization tables to calculate monthly payments and summarize loan repayment details for borrowers. However, you can calculate minimum payments by hand using just the loan amount, interest rate and loan term. The easiest way to calculate payments on an amortized loan is to use a loan amortization calculator or table template. A portion of each installment covers interest and the remaining portion goes toward the loan principal. Loan amortization is the process of scheduling out a fixed-rate loan into equal payments.

0 kommentar(er)

0 kommentar(er)